Managing GCI's Risk

Two years ago, the Economics and Risk (E&R) department was introduced to GCI in order to provide essential functions that had previously been missing. Within the department, the risk management team was created to examine the portfolio as a whole and to identify and address sources of risk. The aim of GCI’s risk management operations is to minimize risk and improve returns, which will be accomplished by instituting a comprehensive set of risk guidelines.

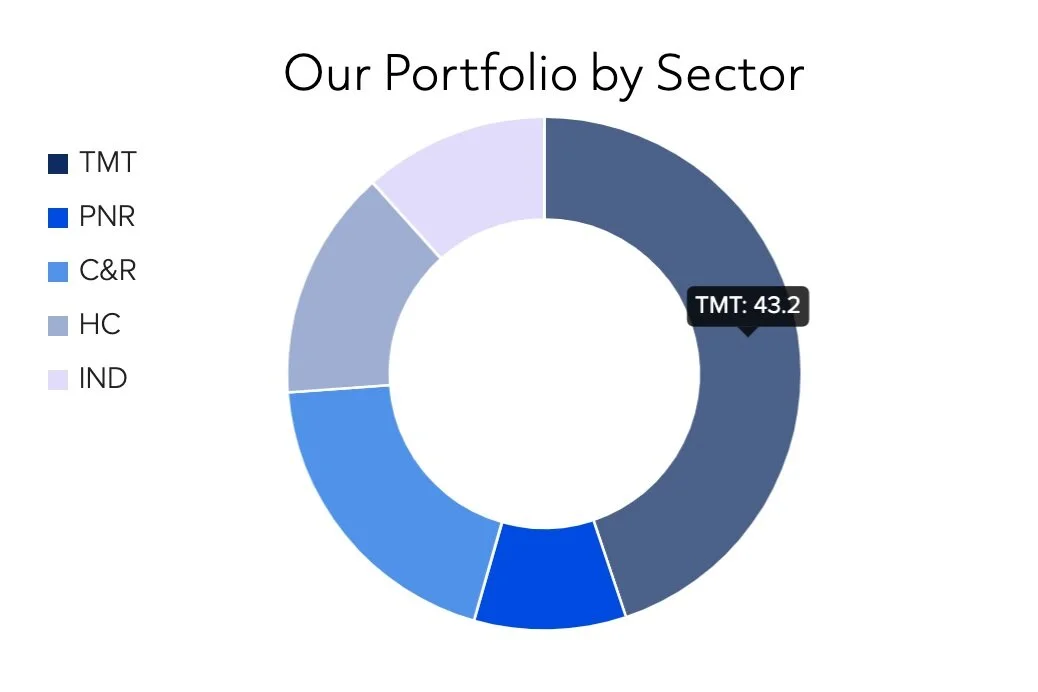

The present composition of the GCI fund has stoked concern over its ability to consolidate losses in a bear market. GCI needs diversification across sectors, as investments in technology, media, and telecommunications (TMT) comprise over 40 percent of all current holdings [see below]. This represents a significant risk to the longevity of the fund; should the TMT sector experience a slowdown, the fund will inevitably underform the market. Furthermore, portfolio diversification will prepare the fund for optimal performance during a future recession.

E&R is looking into ways that the fund can further diversify its portfolio heading into the future, in addition to potential techniques for portfolio rebalancing. In consultation with other leading student investment funds, E&R has drafted guidelines that consider a stock’s “active risk,” measured as a standard deviation of its returns above a benchmark. Several funds have established benchmarks with active risk that result in position liquidation if a security exceeds a predetermined threshold. After a position is liquidated, a decision is made about the reinvestment policy for the cash. One option is to place this cash into a passive index fund such as the S&P 500 index; however, this still exposes the position to market risk. As an alternative, a liquidated position can be placed into a riskless asset such as a Treasury Bill account. Last semester, GCI began to do this with its uninvested cash in order for this uninvested money to achieve higher returns than its savings account rate.

In light of recent Covid-19 related disruptions, E&R has a phenomenal opportunity to analyze and potentially implement guidelines that promote greater portfolio diversification in order to minimize risk. Likewise, it will be interesting to see whether new investment strategies can be adopted based on business fundamentals as well as corporate financing decisions. For example, will GCI avoid companies that engaged in large scale stock buybacks during the previous economic expansion? Critics of this trend indicate it as being a secondary contributor to distress faced by American companies after a quarter of plummeting revenues. Given the recent circumstances, it will be incredibly challenging for the fund to continue to invest with a value oriented philosophy amidst a highly volatile market. That being said, the insights and expertise that can be devised during this testing period will strengthen the fund’s performance for years to come.