GCI Market Research: 2020 Election and the Stock Market

November 2 Update:

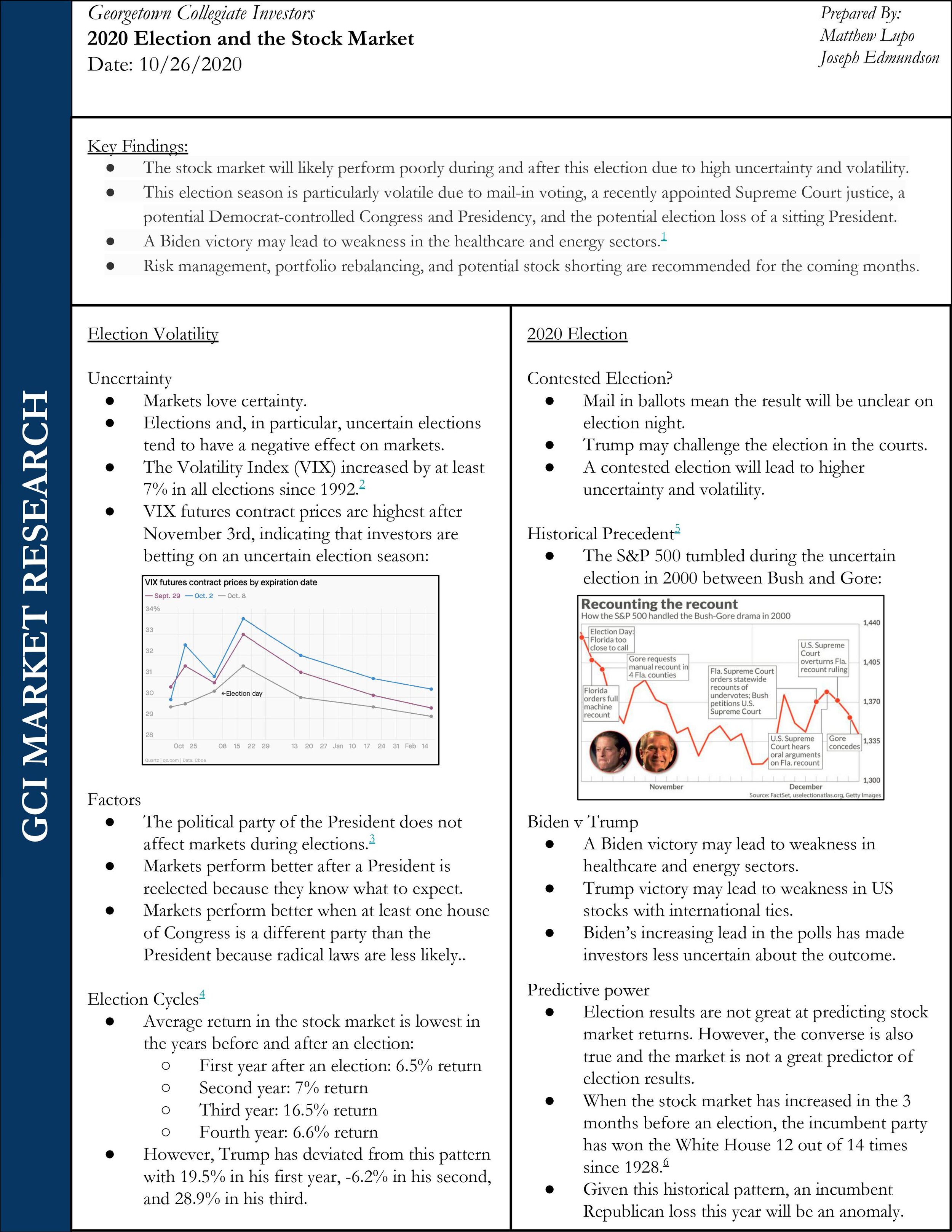

This week the VIX (an index that tracks expectations of market volatility) is at its highest point since June’s mass protests. There is an overall feeling that, whatever the election result, the next few weeks or months will be turbulent. A contested election ballot count will likely involve civil unrest and political conflict that negatively impact the market, and brick-and-mortar retailers are bracing for damages similar to those that occurred during this summer’s unrest.

The general consensus is that Biden will probably win the White House. This would leave an unpredictable lame duck Trump in office for two months, so this volatility will likely continue for a while. A Democratic Senate majority is also likely, though not as likely as a Biden victory, and a landslide Democratic victory in both Congress and the Presidency is perhaps the outcome that will lead to the most certainty and therefore the least market fluctuation, as long as the election results are agreed upon and Trump concedes. A close presidential election, or Biden taking office with a Republican-controlled Senate, are both outcomes that are possible and will need to be watched carefully because they could cause much turmoil in the market as investors attempt to figure out what comes next.

-E&R Economic Research Team